SaaS LTV and CAC Benchmarks- How Does Your Company Compare?

SaaS LTV and CAC Benchmarks- How Does Your Company Compare?

SaaS LTV and CAC Benchmarks- How Does Your Company Compare?

Discover key SaaS LTV and CAC benchmarks to see how your company stacks up. Understand industry standards and optimize your growth strategy.

Discover key SaaS LTV and CAC benchmarks to see how your company stacks up. Understand industry standards and optimize your growth strategy.

Introduction

Importance of LTV and CAC in SaaS

Let's cut to the chase: if you're in the SaaS game, you've probably heard the terms LTV (Lifetime Value) and CAC (Customer Acquisition Cost) thrown around more than a beach ball at a summer concert. These metrics aren't just buzzwords; they're the bread and butter of understanding your company's financial health. Knowing your LTV and CAC inside out can make the difference between scaling like a rocket or crashing like... well, a rocket without fuel. So, if you’re ready to stop guessing and start knowing, keep reading.

Purpose of the Article

Ever wondered how your company stacks up against industry standards? Well, wonder no more. This article is your ultimate cheat sheet for ltv saas benchmarks. We'll break down the average LTV, CAC, and the all-important LTV-CAC ratio across different SaaS sectors and growth stages. Consider this your roadmap to identifying where you shine and where you might need a bit of polish. By the end, you'll have actionable insights to fine-tune your strategies and, dare we say, impress your investors. Ready to dive in? Let's get started.

Understanding LTV and CAC

What is LTV (Customer Lifetime Value)?

Definition and Significance

Customer Lifetime Value (LTV) is the total revenue a business expects to earn from a customer over the entire duration of their relationship. In the SaaS world, understanding LTV is crucial because it helps companies gauge the long-term value of their customer base. Higher LTV indicates that customers are more valuable, which can justify higher acquisition costs and more significant investments in customer retention strategies.

Basic Formula for Calculating LTV

The basic formula for calculating LTV is straightforward:

LTV = Average Revenue Per User (ARPU) × Customer Lifetime

For example, if your ARPU is $100 per month and the average customer stays with you for 12 months, your LTV would be $1,200.

Advanced Methods for Calculating LTV (Including Discounting and Segmentation)

While the basic formula gives a good starting point, advanced methods provide a more accurate picture:

Discounting: This method accounts for the time value of money. Future revenues are discounted back to their present value using a discount rate.

Segmentation: Different customer segments may have different LTVs. Segmenting your customers based on behavior, demographics, or purchase history can provide more granular insights.

For example, using a discount rate of 10%, the present value of future revenues can be calculated as follows:

Discounted LTV = (Revenue Per Period) / (1 + Discount Rate)^Number of Periods

What is CAC (Customer Acquisition Cost)?

Definition and Significance

Customer Acquisition Cost (CAC) is the total cost incurred to acquire a new customer. This includes marketing expenses, sales costs, and any other costs directly associated with acquiring customers. Understanding CAC is vital for SaaS companies because it helps in evaluating the efficiency of their customer acquisition strategies. A lower CAC means you are acquiring customers more efficiently, which can lead to higher profitability.

Basic Formula for Calculating CAC

The basic formula for calculating CAC is:

CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

For instance, if you spent $50,000 on sales and marketing in a month and acquired 500 new customers, your CAC would be $100.

Common Mistakes in Calculating CAC

Calculating CAC might seem simple, but there are common pitfalls to avoid:

Ignoring Indirect Costs: Failing to account for indirect costs like salaries of marketing staff or software tools can lead to underestimating CAC.

Not Segmenting by Channel: Different marketing channels may have different CACs. Not segmenting can obscure which channels are most efficient.

Overlooking Customer Lifetime: Only considering short-term acquisition costs without factoring in the long-term value can give a skewed perspective.

To dive deeper into improving your lead quality and conversion rates, check out our 10 Strategies for Improving Lead Quality and Conversion Rates.

The LTV:CAC Ratio

Definition and Importance

The LTV:CAC ratio compares the lifetime value (LTV) of a customer to the cost of acquiring that customer (CAC). This metric is essential for understanding how efficiently your company is acquiring valuable customers. A higher ratio indicates that the value generated from customers significantly exceeds the cost of acquiring them, which is a good sign for profitability.

What the LTV:CAC Ratio Indicates

The LTV:CAC ratio provides insights into the sustainability and efficiency of your business model. A ratio greater than 1.0 suggests that your company is generating more value from customers than it costs to acquire them. Ideally, a ratio of 3:1 or higher is considered healthy in the SaaS industry, indicating that for every dollar spent on acquiring customers, three dollars are generated in return.

Why It’s Crucial for SaaS Companies

For SaaS companies, the LTV:CAC ratio is a key performance indicator. It helps in assessing the effectiveness of your marketing and sales strategies. A low ratio may indicate that your acquisition costs are too high or that your customer retention strategies need improvement. On the other hand, a very high ratio might suggest under-investment in customer acquisition, potentially missing out on growth opportunities.

How to Calculate the LTV:CAC Ratio

Calculating the LTV:CAC ratio involves two main components: LTV and CAC. Here’s a step-by-step guide:

Step-by-Step Guide

Calculate LTV:

Average Revenue per Customer: Determine the average revenue generated per customer over a specific period.

Customer Lifetime: Estimate the average duration a customer remains with your company.

Formula: LTV = Average Revenue per Customer × Customer Lifetime

Calculate CAC:

Total Sales and Marketing Expenses: Sum up all costs related to acquiring customers, including advertising, sales team salaries, and marketing campaigns.

Number of New Customers Acquired: Count the number of new customers gained during the same period.

Formula: CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

Calculate the LTV:CAC Ratio:

Formula: LTV:CAC Ratio = LTV / CAC

Example Calculation

Let’s say your SaaS company spent $50,000 on marketing and sales last quarter and acquired 500 new customers. The average revenue per customer is $200 per year, and the average customer lifetime is 3 years.

LTV: $200 × 3 = $600

CAC: $50,000 / 500 = $100

LTV:CAC Ratio: $600 / $100 = 6.0

This ratio of 6.0 indicates a highly efficient customer acquisition strategy, suggesting that the company is generating six times the value of what it spends on acquiring each customer.

For more insights on improving your LTV and CAC, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Benchmarking Your LTV:CAC Ratio

Industry Standards and Benchmarks

Understanding where your company stands in terms of LTV:CAC ratio is crucial. Industry benchmarks provide a reference point to gauge your performance. For SaaS companies, a common benchmark is an LTV:CAC ratio of 3:1. This means that for every dollar spent on customer acquisition, you should be earning three dollars in customer lifetime value.

However, these benchmarks can vary widely. Early-stage companies might have a lower ratio as they invest heavily in growth, while mature companies often aim for higher ratios to maximize profitability.

Typical LTV:CAC Ratios for SaaS Companies

Startup Stage: 1:1 to 3:1

Growth Stage: 3:1 to 5:1

Mature Stage: 5:1 and above

These ratios are not set in stone but provide a useful framework. A startup might have a 1:1 ratio initially, indicating that they are breaking even on acquisition costs. As the company grows and optimizes its processes, the ratio should improve.

Differences by Company Stage and Industry

The LTV:CAC ratio can also differ significantly by industry. For example, B2B SaaS companies often have higher ratios compared to B2C due to longer sales cycles and higher customer retention rates. Additionally, the company stage plays a role:

Early-Stage: Focus is on acquiring customers quickly, often resulting in higher CAC and lower LTV.

Growth-Stage: Optimization of acquisition channels and customer retention strategies improve the ratio.

Mature-Stage: Established customer base and efficient acquisition strategies lead to higher LTV:CAC ratios.

Interpreting Your LTV:CAC Ratio

Interpreting your LTV:CAC ratio helps you understand your company's health and growth potential. Here’s a quick guide:

1:1 Ratio: You’re breaking even. Not ideal for long-term growth.

2:1 Ratio: Better, but still room for improvement.

3:1 Ratio: Ideal for most SaaS companies. Indicates good performance.

5:1 Ratio: Excellent, but might suggest underinvestment in marketing.

What Different LTV:CAC Ratios Mean

Different ratios tell different stories:

Low Ratio (1:1 or lower): You’re spending too much on acquisition or your customers aren’t sticking around long enough. Time to revisit your marketing and retention strategies.

Moderate Ratio (2:1 to 3:1): You’re on the right track but could optimize further. Consider fine-tuning your sales processes and customer engagement tactics.

High Ratio (4:1 or higher): Great job! But beware of underinvesting in marketing. You might be leaving growth opportunities on the table.

Avoiding Common Pitfalls (e.g., Too High or Too Low Ratios)

Here are some common pitfalls to avoid:

Too Low Ratio: Indicates inefficiencies in your acquisition strategy. Consider leveraging strategies for improving lead quality and optimizing your sales funnel.

Too High Ratio: While a high ratio is good, it might mean you’re not investing enough in growth. Look into developing a robust growth strategy.

Ignoring Customer Segmentation: Not all customers are created equal. Segment your customers to identify the most profitable ones and tailor your marketing efforts accordingly.

For more detailed insights, check out our guide on the impact of programmatic SEO on SaaS customer lifetime value.

Strategies to Improve Your LTV:CAC Ratio

Reducing CAC

Reducing your Customer Acquisition Cost (CAC) is a surefire way to improve your LTV:CAC ratio. Here are some actionable strategies:

Leverage Inbound Marketing: Focus on content marketing, SEO, and social media to attract leads organically. Check out our guide on programmatic SEO for more insights.

Optimize Paid Campaigns: Use data-driven approaches to refine your ad targeting and reduce wasted spend.

Referral Programs: Encourage existing customers to refer new ones by offering incentives.

Effective Marketing Channels

Choosing the right marketing channels can significantly impact your CAC. Here are some effective channels:

Content Marketing: Create valuable content that addresses your audience's pain points. For tips, read our post on improving lead quality and conversion rates.

Email Marketing: Nurture leads through personalized email campaigns.

Social Media: Use platforms like LinkedIn and Twitter to engage with your target audience.

Optimizing Sales Processes

Streamlining your sales processes can help reduce CAC and improve efficiency. Consider these tactics:

CRM Tools: Utilize CRM software to manage leads and automate follow-ups.

Sales Training: Invest in training your sales team to improve conversion rates.

Lead Scoring: Implement lead scoring to prioritize high-quality leads.

Increasing LTV

Boosting your Customer Lifetime Value (LTV) is another way to improve your LTV:CAC ratio. Here’s how:

Enhancing Customer Retention

Retaining customers longer increases their lifetime value. Here are some retention strategies:

Customer Support: Provide excellent customer service to keep customers happy.

Regular Check-ins: Schedule periodic check-ins to ensure customers are satisfied.

Feedback Loops: Use customer feedback to improve your product and service.

Upselling and Cross-selling Strategies

Encouraging existing customers to purchase more can significantly increase LTV. Try these approaches:

Product Bundles: Offer bundles that provide more value at a discounted rate.

Feature Upgrades: Promote premium features that enhance the customer experience.

Personalized Recommendations: Use data to suggest products or services that match customer needs.

Tools and Software for Tracking LTV and CAC

Overview of Popular Tools

Tracking your LTV (Lifetime Value) and CAC (Customer Acquisition Cost) is crucial for any SaaS business. Thankfully, there are some fantastic tools out there to help you keep tabs on these metrics. Let's dive into three popular options: Geckoboard, Klipfolio, and ChartMogul.

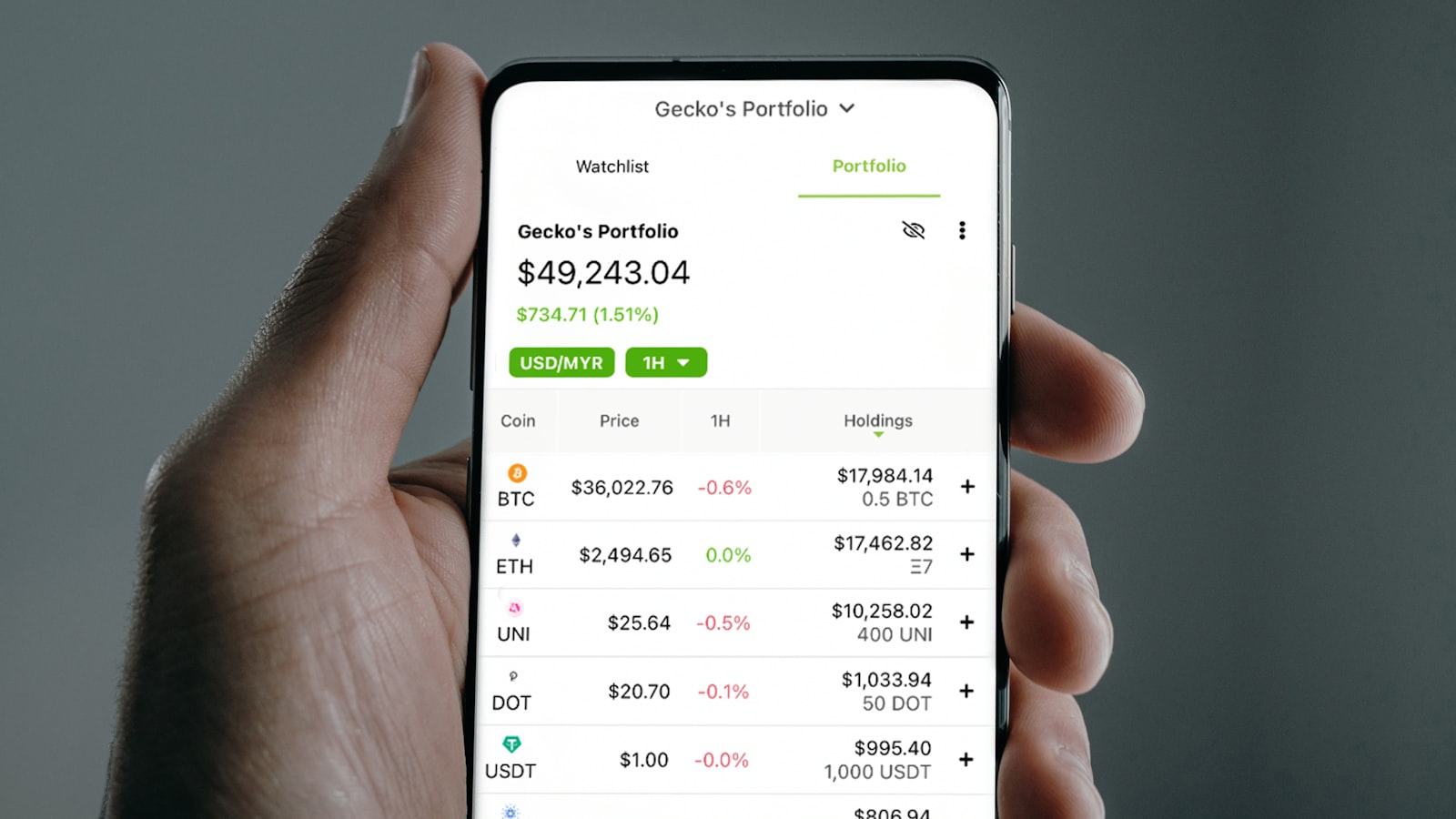

Geckoboard

Geckoboard is a real-time dashboard tool that allows you to visualize your key metrics, including LTV and CAC. It's user-friendly, integrates with various data sources, and provides clear, customizable dashboards. This makes it easier to keep an eye on your metrics without getting lost in a sea of data.

Klipfolio

Klipfolio offers robust data visualization capabilities. It supports a wide range of integrations, allowing you to pull data from multiple sources. Klipfolio's flexibility in creating custom dashboards makes it a powerful tool for tracking LTV and CAC, tailored to your specific needs.

ChartMogul

ChartMogul is specifically designed for subscription businesses. It excels in calculating and analyzing SaaS metrics, including LTV and CAC. With ChartMogul, you can easily track your revenue metrics, segment customers, and get detailed insights into your business performance.

How to Choose the Right Tool

Choosing the right tool for tracking LTV and CAC depends on your specific needs and budget. Here are some key factors to consider:

Key Features to Look For

Integration Capabilities: Ensure the tool integrates with your existing systems and data sources.

Customizability: Look for tools that allow you to create custom dashboards and reports.

Real-Time Data: Real-time tracking can help you make timely decisions.

User-Friendly Interface: A tool that's easy to use will save you time and reduce frustration.

Support and Training: Consider the availability of customer support and training resources.

Cost Considerations

Cost is always a factor when choosing software. Here are some points to keep in mind:

Subscription Fees: Compare the subscription costs of different tools. Some might offer tiered pricing based on features or the number of users.

Hidden Costs: Watch out for additional costs, such as integration fees or charges for extra features.

Free Trials: Take advantage of free trials to test the tools before committing.

For more insights on improving your SaaS metrics, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Conclusion

Recap of Key Points

We've covered a lot of ground in this article about LTV SaaS and CAC benchmarks. Here's a quick recap:

Understanding LTV and CAC: We defined Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC), discussed their significance, and explained how to calculate them.

The LTV:CAC Ratio: We explored the importance of the LTV:CAC ratio, what it indicates, and how to calculate it.

Benchmarking Your LTV:CAC Ratio: We looked at industry standards and benchmarks, and how to interpret your company's ratio.

Strategies to Improve Your LTV:CAC Ratio: We provided actionable strategies to reduce CAC and increase LTV, including effective marketing channels and customer retention techniques.

Tools and Software: We reviewed popular tools like Geckoboard, Klipfolio, and ChartMogul for tracking LTV and CAC, and discussed how to choose the right tool for your business.

Final Thoughts and Recommendations

Improving your LTV:CAC ratio is crucial for the success of your SaaS business. Here are some final recommendations:

Focus on Customer Retention: Retaining customers is often more cost-effective than acquiring new ones. Implement strategies to keep your customers happy and engaged.

Optimize Your Sales Funnel: Streamline your sales processes to reduce CAC. Check out our 10 SaaS Sales Funnel Best Practices for more tips.

Leverage Data-Driven Marketing: Use data to identify the most effective marketing channels. For more insights, read our article on Improving Lead Quality and Conversion Rates.

Invest in the Right Tools: Choose tools that provide comprehensive analytics and are easy to integrate with your existing systems. Our guide on Developing a Winning SaaS Growth Strategy can help you make informed decisions.

By focusing on these areas, you can improve your LTV:CAC ratio and drive sustainable growth for your SaaS business. Remember, it's all about finding the right balance between acquiring new customers and maximizing the value of your existing ones.

Additional Resources

Links to Further Reading

To deepen your understanding of SaaS LTV and CAC benchmarks, check out these insightful articles:

The Impact of Programmatic SEO on SaaS Customer Lifetime Value

10 Strategies for Improving Lead Quality and Conversion Rates

How to Develop a High-Performing SaaS Lead Generation Strategy

10 SaaS Sales Funnel Best Practices to Skyrocket Your Revenue

Recommended Tools and Software

Tracking LTV and CAC effectively requires the right tools. Here are some top recommendations:

Geckoboard: A user-friendly dashboard tool that helps you visualize and track key SaaS metrics. Learn more.

Klipfolio: Offers powerful data visualization and reporting capabilities, making it easy to monitor LTV and CAC. Learn more.

ChartMogul: Specifically designed for SaaS businesses, this tool provides detailed analytics on customer metrics. Learn more.

Introduction

Importance of LTV and CAC in SaaS

Let's cut to the chase: if you're in the SaaS game, you've probably heard the terms LTV (Lifetime Value) and CAC (Customer Acquisition Cost) thrown around more than a beach ball at a summer concert. These metrics aren't just buzzwords; they're the bread and butter of understanding your company's financial health. Knowing your LTV and CAC inside out can make the difference between scaling like a rocket or crashing like... well, a rocket without fuel. So, if you’re ready to stop guessing and start knowing, keep reading.

Purpose of the Article

Ever wondered how your company stacks up against industry standards? Well, wonder no more. This article is your ultimate cheat sheet for ltv saas benchmarks. We'll break down the average LTV, CAC, and the all-important LTV-CAC ratio across different SaaS sectors and growth stages. Consider this your roadmap to identifying where you shine and where you might need a bit of polish. By the end, you'll have actionable insights to fine-tune your strategies and, dare we say, impress your investors. Ready to dive in? Let's get started.

Understanding LTV and CAC

What is LTV (Customer Lifetime Value)?

Definition and Significance

Customer Lifetime Value (LTV) is the total revenue a business expects to earn from a customer over the entire duration of their relationship. In the SaaS world, understanding LTV is crucial because it helps companies gauge the long-term value of their customer base. Higher LTV indicates that customers are more valuable, which can justify higher acquisition costs and more significant investments in customer retention strategies.

Basic Formula for Calculating LTV

The basic formula for calculating LTV is straightforward:

LTV = Average Revenue Per User (ARPU) × Customer Lifetime

For example, if your ARPU is $100 per month and the average customer stays with you for 12 months, your LTV would be $1,200.

Advanced Methods for Calculating LTV (Including Discounting and Segmentation)

While the basic formula gives a good starting point, advanced methods provide a more accurate picture:

Discounting: This method accounts for the time value of money. Future revenues are discounted back to their present value using a discount rate.

Segmentation: Different customer segments may have different LTVs. Segmenting your customers based on behavior, demographics, or purchase history can provide more granular insights.

For example, using a discount rate of 10%, the present value of future revenues can be calculated as follows:

Discounted LTV = (Revenue Per Period) / (1 + Discount Rate)^Number of Periods

What is CAC (Customer Acquisition Cost)?

Definition and Significance

Customer Acquisition Cost (CAC) is the total cost incurred to acquire a new customer. This includes marketing expenses, sales costs, and any other costs directly associated with acquiring customers. Understanding CAC is vital for SaaS companies because it helps in evaluating the efficiency of their customer acquisition strategies. A lower CAC means you are acquiring customers more efficiently, which can lead to higher profitability.

Basic Formula for Calculating CAC

The basic formula for calculating CAC is:

CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

For instance, if you spent $50,000 on sales and marketing in a month and acquired 500 new customers, your CAC would be $100.

Common Mistakes in Calculating CAC

Calculating CAC might seem simple, but there are common pitfalls to avoid:

Ignoring Indirect Costs: Failing to account for indirect costs like salaries of marketing staff or software tools can lead to underestimating CAC.

Not Segmenting by Channel: Different marketing channels may have different CACs. Not segmenting can obscure which channels are most efficient.

Overlooking Customer Lifetime: Only considering short-term acquisition costs without factoring in the long-term value can give a skewed perspective.

To dive deeper into improving your lead quality and conversion rates, check out our 10 Strategies for Improving Lead Quality and Conversion Rates.

The LTV:CAC Ratio

Definition and Importance

The LTV:CAC ratio compares the lifetime value (LTV) of a customer to the cost of acquiring that customer (CAC). This metric is essential for understanding how efficiently your company is acquiring valuable customers. A higher ratio indicates that the value generated from customers significantly exceeds the cost of acquiring them, which is a good sign for profitability.

What the LTV:CAC Ratio Indicates

The LTV:CAC ratio provides insights into the sustainability and efficiency of your business model. A ratio greater than 1.0 suggests that your company is generating more value from customers than it costs to acquire them. Ideally, a ratio of 3:1 or higher is considered healthy in the SaaS industry, indicating that for every dollar spent on acquiring customers, three dollars are generated in return.

Why It’s Crucial for SaaS Companies

For SaaS companies, the LTV:CAC ratio is a key performance indicator. It helps in assessing the effectiveness of your marketing and sales strategies. A low ratio may indicate that your acquisition costs are too high or that your customer retention strategies need improvement. On the other hand, a very high ratio might suggest under-investment in customer acquisition, potentially missing out on growth opportunities.

How to Calculate the LTV:CAC Ratio

Calculating the LTV:CAC ratio involves two main components: LTV and CAC. Here’s a step-by-step guide:

Step-by-Step Guide

Calculate LTV:

Average Revenue per Customer: Determine the average revenue generated per customer over a specific period.

Customer Lifetime: Estimate the average duration a customer remains with your company.

Formula: LTV = Average Revenue per Customer × Customer Lifetime

Calculate CAC:

Total Sales and Marketing Expenses: Sum up all costs related to acquiring customers, including advertising, sales team salaries, and marketing campaigns.

Number of New Customers Acquired: Count the number of new customers gained during the same period.

Formula: CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

Calculate the LTV:CAC Ratio:

Formula: LTV:CAC Ratio = LTV / CAC

Example Calculation

Let’s say your SaaS company spent $50,000 on marketing and sales last quarter and acquired 500 new customers. The average revenue per customer is $200 per year, and the average customer lifetime is 3 years.

LTV: $200 × 3 = $600

CAC: $50,000 / 500 = $100

LTV:CAC Ratio: $600 / $100 = 6.0

This ratio of 6.0 indicates a highly efficient customer acquisition strategy, suggesting that the company is generating six times the value of what it spends on acquiring each customer.

For more insights on improving your LTV and CAC, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Benchmarking Your LTV:CAC Ratio

Industry Standards and Benchmarks

Understanding where your company stands in terms of LTV:CAC ratio is crucial. Industry benchmarks provide a reference point to gauge your performance. For SaaS companies, a common benchmark is an LTV:CAC ratio of 3:1. This means that for every dollar spent on customer acquisition, you should be earning three dollars in customer lifetime value.

However, these benchmarks can vary widely. Early-stage companies might have a lower ratio as they invest heavily in growth, while mature companies often aim for higher ratios to maximize profitability.

Typical LTV:CAC Ratios for SaaS Companies

Startup Stage: 1:1 to 3:1

Growth Stage: 3:1 to 5:1

Mature Stage: 5:1 and above

These ratios are not set in stone but provide a useful framework. A startup might have a 1:1 ratio initially, indicating that they are breaking even on acquisition costs. As the company grows and optimizes its processes, the ratio should improve.

Differences by Company Stage and Industry

The LTV:CAC ratio can also differ significantly by industry. For example, B2B SaaS companies often have higher ratios compared to B2C due to longer sales cycles and higher customer retention rates. Additionally, the company stage plays a role:

Early-Stage: Focus is on acquiring customers quickly, often resulting in higher CAC and lower LTV.

Growth-Stage: Optimization of acquisition channels and customer retention strategies improve the ratio.

Mature-Stage: Established customer base and efficient acquisition strategies lead to higher LTV:CAC ratios.

Interpreting Your LTV:CAC Ratio

Interpreting your LTV:CAC ratio helps you understand your company's health and growth potential. Here’s a quick guide:

1:1 Ratio: You’re breaking even. Not ideal for long-term growth.

2:1 Ratio: Better, but still room for improvement.

3:1 Ratio: Ideal for most SaaS companies. Indicates good performance.

5:1 Ratio: Excellent, but might suggest underinvestment in marketing.

What Different LTV:CAC Ratios Mean

Different ratios tell different stories:

Low Ratio (1:1 or lower): You’re spending too much on acquisition or your customers aren’t sticking around long enough. Time to revisit your marketing and retention strategies.

Moderate Ratio (2:1 to 3:1): You’re on the right track but could optimize further. Consider fine-tuning your sales processes and customer engagement tactics.

High Ratio (4:1 or higher): Great job! But beware of underinvesting in marketing. You might be leaving growth opportunities on the table.

Avoiding Common Pitfalls (e.g., Too High or Too Low Ratios)

Here are some common pitfalls to avoid:

Too Low Ratio: Indicates inefficiencies in your acquisition strategy. Consider leveraging strategies for improving lead quality and optimizing your sales funnel.

Too High Ratio: While a high ratio is good, it might mean you’re not investing enough in growth. Look into developing a robust growth strategy.

Ignoring Customer Segmentation: Not all customers are created equal. Segment your customers to identify the most profitable ones and tailor your marketing efforts accordingly.

For more detailed insights, check out our guide on the impact of programmatic SEO on SaaS customer lifetime value.

Strategies to Improve Your LTV:CAC Ratio

Reducing CAC

Reducing your Customer Acquisition Cost (CAC) is a surefire way to improve your LTV:CAC ratio. Here are some actionable strategies:

Leverage Inbound Marketing: Focus on content marketing, SEO, and social media to attract leads organically. Check out our guide on programmatic SEO for more insights.

Optimize Paid Campaigns: Use data-driven approaches to refine your ad targeting and reduce wasted spend.

Referral Programs: Encourage existing customers to refer new ones by offering incentives.

Effective Marketing Channels

Choosing the right marketing channels can significantly impact your CAC. Here are some effective channels:

Content Marketing: Create valuable content that addresses your audience's pain points. For tips, read our post on improving lead quality and conversion rates.

Email Marketing: Nurture leads through personalized email campaigns.

Social Media: Use platforms like LinkedIn and Twitter to engage with your target audience.

Optimizing Sales Processes

Streamlining your sales processes can help reduce CAC and improve efficiency. Consider these tactics:

CRM Tools: Utilize CRM software to manage leads and automate follow-ups.

Sales Training: Invest in training your sales team to improve conversion rates.

Lead Scoring: Implement lead scoring to prioritize high-quality leads.

Increasing LTV

Boosting your Customer Lifetime Value (LTV) is another way to improve your LTV:CAC ratio. Here’s how:

Enhancing Customer Retention

Retaining customers longer increases their lifetime value. Here are some retention strategies:

Customer Support: Provide excellent customer service to keep customers happy.

Regular Check-ins: Schedule periodic check-ins to ensure customers are satisfied.

Feedback Loops: Use customer feedback to improve your product and service.

Upselling and Cross-selling Strategies

Encouraging existing customers to purchase more can significantly increase LTV. Try these approaches:

Product Bundles: Offer bundles that provide more value at a discounted rate.

Feature Upgrades: Promote premium features that enhance the customer experience.

Personalized Recommendations: Use data to suggest products or services that match customer needs.

Tools and Software for Tracking LTV and CAC

Overview of Popular Tools

Tracking your LTV (Lifetime Value) and CAC (Customer Acquisition Cost) is crucial for any SaaS business. Thankfully, there are some fantastic tools out there to help you keep tabs on these metrics. Let's dive into three popular options: Geckoboard, Klipfolio, and ChartMogul.

Geckoboard

Geckoboard is a real-time dashboard tool that allows you to visualize your key metrics, including LTV and CAC. It's user-friendly, integrates with various data sources, and provides clear, customizable dashboards. This makes it easier to keep an eye on your metrics without getting lost in a sea of data.

Klipfolio

Klipfolio offers robust data visualization capabilities. It supports a wide range of integrations, allowing you to pull data from multiple sources. Klipfolio's flexibility in creating custom dashboards makes it a powerful tool for tracking LTV and CAC, tailored to your specific needs.

ChartMogul

ChartMogul is specifically designed for subscription businesses. It excels in calculating and analyzing SaaS metrics, including LTV and CAC. With ChartMogul, you can easily track your revenue metrics, segment customers, and get detailed insights into your business performance.

How to Choose the Right Tool

Choosing the right tool for tracking LTV and CAC depends on your specific needs and budget. Here are some key factors to consider:

Key Features to Look For

Integration Capabilities: Ensure the tool integrates with your existing systems and data sources.

Customizability: Look for tools that allow you to create custom dashboards and reports.

Real-Time Data: Real-time tracking can help you make timely decisions.

User-Friendly Interface: A tool that's easy to use will save you time and reduce frustration.

Support and Training: Consider the availability of customer support and training resources.

Cost Considerations

Cost is always a factor when choosing software. Here are some points to keep in mind:

Subscription Fees: Compare the subscription costs of different tools. Some might offer tiered pricing based on features or the number of users.

Hidden Costs: Watch out for additional costs, such as integration fees or charges for extra features.

Free Trials: Take advantage of free trials to test the tools before committing.

For more insights on improving your SaaS metrics, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Conclusion

Recap of Key Points

We've covered a lot of ground in this article about LTV SaaS and CAC benchmarks. Here's a quick recap:

Understanding LTV and CAC: We defined Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC), discussed their significance, and explained how to calculate them.

The LTV:CAC Ratio: We explored the importance of the LTV:CAC ratio, what it indicates, and how to calculate it.

Benchmarking Your LTV:CAC Ratio: We looked at industry standards and benchmarks, and how to interpret your company's ratio.

Strategies to Improve Your LTV:CAC Ratio: We provided actionable strategies to reduce CAC and increase LTV, including effective marketing channels and customer retention techniques.

Tools and Software: We reviewed popular tools like Geckoboard, Klipfolio, and ChartMogul for tracking LTV and CAC, and discussed how to choose the right tool for your business.

Final Thoughts and Recommendations

Improving your LTV:CAC ratio is crucial for the success of your SaaS business. Here are some final recommendations:

Focus on Customer Retention: Retaining customers is often more cost-effective than acquiring new ones. Implement strategies to keep your customers happy and engaged.

Optimize Your Sales Funnel: Streamline your sales processes to reduce CAC. Check out our 10 SaaS Sales Funnel Best Practices for more tips.

Leverage Data-Driven Marketing: Use data to identify the most effective marketing channels. For more insights, read our article on Improving Lead Quality and Conversion Rates.

Invest in the Right Tools: Choose tools that provide comprehensive analytics and are easy to integrate with your existing systems. Our guide on Developing a Winning SaaS Growth Strategy can help you make informed decisions.

By focusing on these areas, you can improve your LTV:CAC ratio and drive sustainable growth for your SaaS business. Remember, it's all about finding the right balance between acquiring new customers and maximizing the value of your existing ones.

Additional Resources

Links to Further Reading

To deepen your understanding of SaaS LTV and CAC benchmarks, check out these insightful articles:

The Impact of Programmatic SEO on SaaS Customer Lifetime Value

10 Strategies for Improving Lead Quality and Conversion Rates

How to Develop a High-Performing SaaS Lead Generation Strategy

10 SaaS Sales Funnel Best Practices to Skyrocket Your Revenue

Recommended Tools and Software

Tracking LTV and CAC effectively requires the right tools. Here are some top recommendations:

Geckoboard: A user-friendly dashboard tool that helps you visualize and track key SaaS metrics. Learn more.

Klipfolio: Offers powerful data visualization and reporting capabilities, making it easy to monitor LTV and CAC. Learn more.

ChartMogul: Specifically designed for SaaS businesses, this tool provides detailed analytics on customer metrics. Learn more.

Introduction

Importance of LTV and CAC in SaaS

Let's cut to the chase: if you're in the SaaS game, you've probably heard the terms LTV (Lifetime Value) and CAC (Customer Acquisition Cost) thrown around more than a beach ball at a summer concert. These metrics aren't just buzzwords; they're the bread and butter of understanding your company's financial health. Knowing your LTV and CAC inside out can make the difference between scaling like a rocket or crashing like... well, a rocket without fuel. So, if you’re ready to stop guessing and start knowing, keep reading.

Purpose of the Article

Ever wondered how your company stacks up against industry standards? Well, wonder no more. This article is your ultimate cheat sheet for ltv saas benchmarks. We'll break down the average LTV, CAC, and the all-important LTV-CAC ratio across different SaaS sectors and growth stages. Consider this your roadmap to identifying where you shine and where you might need a bit of polish. By the end, you'll have actionable insights to fine-tune your strategies and, dare we say, impress your investors. Ready to dive in? Let's get started.

Understanding LTV and CAC

What is LTV (Customer Lifetime Value)?

Definition and Significance

Customer Lifetime Value (LTV) is the total revenue a business expects to earn from a customer over the entire duration of their relationship. In the SaaS world, understanding LTV is crucial because it helps companies gauge the long-term value of their customer base. Higher LTV indicates that customers are more valuable, which can justify higher acquisition costs and more significant investments in customer retention strategies.

Basic Formula for Calculating LTV

The basic formula for calculating LTV is straightforward:

LTV = Average Revenue Per User (ARPU) × Customer Lifetime

For example, if your ARPU is $100 per month and the average customer stays with you for 12 months, your LTV would be $1,200.

Advanced Methods for Calculating LTV (Including Discounting and Segmentation)

While the basic formula gives a good starting point, advanced methods provide a more accurate picture:

Discounting: This method accounts for the time value of money. Future revenues are discounted back to their present value using a discount rate.

Segmentation: Different customer segments may have different LTVs. Segmenting your customers based on behavior, demographics, or purchase history can provide more granular insights.

For example, using a discount rate of 10%, the present value of future revenues can be calculated as follows:

Discounted LTV = (Revenue Per Period) / (1 + Discount Rate)^Number of Periods

What is CAC (Customer Acquisition Cost)?

Definition and Significance

Customer Acquisition Cost (CAC) is the total cost incurred to acquire a new customer. This includes marketing expenses, sales costs, and any other costs directly associated with acquiring customers. Understanding CAC is vital for SaaS companies because it helps in evaluating the efficiency of their customer acquisition strategies. A lower CAC means you are acquiring customers more efficiently, which can lead to higher profitability.

Basic Formula for Calculating CAC

The basic formula for calculating CAC is:

CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

For instance, if you spent $50,000 on sales and marketing in a month and acquired 500 new customers, your CAC would be $100.

Common Mistakes in Calculating CAC

Calculating CAC might seem simple, but there are common pitfalls to avoid:

Ignoring Indirect Costs: Failing to account for indirect costs like salaries of marketing staff or software tools can lead to underestimating CAC.

Not Segmenting by Channel: Different marketing channels may have different CACs. Not segmenting can obscure which channels are most efficient.

Overlooking Customer Lifetime: Only considering short-term acquisition costs without factoring in the long-term value can give a skewed perspective.

To dive deeper into improving your lead quality and conversion rates, check out our 10 Strategies for Improving Lead Quality and Conversion Rates.

The LTV:CAC Ratio

Definition and Importance

The LTV:CAC ratio compares the lifetime value (LTV) of a customer to the cost of acquiring that customer (CAC). This metric is essential for understanding how efficiently your company is acquiring valuable customers. A higher ratio indicates that the value generated from customers significantly exceeds the cost of acquiring them, which is a good sign for profitability.

What the LTV:CAC Ratio Indicates

The LTV:CAC ratio provides insights into the sustainability and efficiency of your business model. A ratio greater than 1.0 suggests that your company is generating more value from customers than it costs to acquire them. Ideally, a ratio of 3:1 or higher is considered healthy in the SaaS industry, indicating that for every dollar spent on acquiring customers, three dollars are generated in return.

Why It’s Crucial for SaaS Companies

For SaaS companies, the LTV:CAC ratio is a key performance indicator. It helps in assessing the effectiveness of your marketing and sales strategies. A low ratio may indicate that your acquisition costs are too high or that your customer retention strategies need improvement. On the other hand, a very high ratio might suggest under-investment in customer acquisition, potentially missing out on growth opportunities.

How to Calculate the LTV:CAC Ratio

Calculating the LTV:CAC ratio involves two main components: LTV and CAC. Here’s a step-by-step guide:

Step-by-Step Guide

Calculate LTV:

Average Revenue per Customer: Determine the average revenue generated per customer over a specific period.

Customer Lifetime: Estimate the average duration a customer remains with your company.

Formula: LTV = Average Revenue per Customer × Customer Lifetime

Calculate CAC:

Total Sales and Marketing Expenses: Sum up all costs related to acquiring customers, including advertising, sales team salaries, and marketing campaigns.

Number of New Customers Acquired: Count the number of new customers gained during the same period.

Formula: CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

Calculate the LTV:CAC Ratio:

Formula: LTV:CAC Ratio = LTV / CAC

Example Calculation

Let’s say your SaaS company spent $50,000 on marketing and sales last quarter and acquired 500 new customers. The average revenue per customer is $200 per year, and the average customer lifetime is 3 years.

LTV: $200 × 3 = $600

CAC: $50,000 / 500 = $100

LTV:CAC Ratio: $600 / $100 = 6.0

This ratio of 6.0 indicates a highly efficient customer acquisition strategy, suggesting that the company is generating six times the value of what it spends on acquiring each customer.

For more insights on improving your LTV and CAC, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Benchmarking Your LTV:CAC Ratio

Industry Standards and Benchmarks

Understanding where your company stands in terms of LTV:CAC ratio is crucial. Industry benchmarks provide a reference point to gauge your performance. For SaaS companies, a common benchmark is an LTV:CAC ratio of 3:1. This means that for every dollar spent on customer acquisition, you should be earning three dollars in customer lifetime value.

However, these benchmarks can vary widely. Early-stage companies might have a lower ratio as they invest heavily in growth, while mature companies often aim for higher ratios to maximize profitability.

Typical LTV:CAC Ratios for SaaS Companies

Startup Stage: 1:1 to 3:1

Growth Stage: 3:1 to 5:1

Mature Stage: 5:1 and above

These ratios are not set in stone but provide a useful framework. A startup might have a 1:1 ratio initially, indicating that they are breaking even on acquisition costs. As the company grows and optimizes its processes, the ratio should improve.

Differences by Company Stage and Industry

The LTV:CAC ratio can also differ significantly by industry. For example, B2B SaaS companies often have higher ratios compared to B2C due to longer sales cycles and higher customer retention rates. Additionally, the company stage plays a role:

Early-Stage: Focus is on acquiring customers quickly, often resulting in higher CAC and lower LTV.

Growth-Stage: Optimization of acquisition channels and customer retention strategies improve the ratio.

Mature-Stage: Established customer base and efficient acquisition strategies lead to higher LTV:CAC ratios.

Interpreting Your LTV:CAC Ratio

Interpreting your LTV:CAC ratio helps you understand your company's health and growth potential. Here’s a quick guide:

1:1 Ratio: You’re breaking even. Not ideal for long-term growth.

2:1 Ratio: Better, but still room for improvement.

3:1 Ratio: Ideal for most SaaS companies. Indicates good performance.

5:1 Ratio: Excellent, but might suggest underinvestment in marketing.

What Different LTV:CAC Ratios Mean

Different ratios tell different stories:

Low Ratio (1:1 or lower): You’re spending too much on acquisition or your customers aren’t sticking around long enough. Time to revisit your marketing and retention strategies.

Moderate Ratio (2:1 to 3:1): You’re on the right track but could optimize further. Consider fine-tuning your sales processes and customer engagement tactics.

High Ratio (4:1 or higher): Great job! But beware of underinvesting in marketing. You might be leaving growth opportunities on the table.

Avoiding Common Pitfalls (e.g., Too High or Too Low Ratios)

Here are some common pitfalls to avoid:

Too Low Ratio: Indicates inefficiencies in your acquisition strategy. Consider leveraging strategies for improving lead quality and optimizing your sales funnel.

Too High Ratio: While a high ratio is good, it might mean you’re not investing enough in growth. Look into developing a robust growth strategy.

Ignoring Customer Segmentation: Not all customers are created equal. Segment your customers to identify the most profitable ones and tailor your marketing efforts accordingly.

For more detailed insights, check out our guide on the impact of programmatic SEO on SaaS customer lifetime value.

Strategies to Improve Your LTV:CAC Ratio

Reducing CAC

Reducing your Customer Acquisition Cost (CAC) is a surefire way to improve your LTV:CAC ratio. Here are some actionable strategies:

Leverage Inbound Marketing: Focus on content marketing, SEO, and social media to attract leads organically. Check out our guide on programmatic SEO for more insights.

Optimize Paid Campaigns: Use data-driven approaches to refine your ad targeting and reduce wasted spend.

Referral Programs: Encourage existing customers to refer new ones by offering incentives.

Effective Marketing Channels

Choosing the right marketing channels can significantly impact your CAC. Here are some effective channels:

Content Marketing: Create valuable content that addresses your audience's pain points. For tips, read our post on improving lead quality and conversion rates.

Email Marketing: Nurture leads through personalized email campaigns.

Social Media: Use platforms like LinkedIn and Twitter to engage with your target audience.

Optimizing Sales Processes

Streamlining your sales processes can help reduce CAC and improve efficiency. Consider these tactics:

CRM Tools: Utilize CRM software to manage leads and automate follow-ups.

Sales Training: Invest in training your sales team to improve conversion rates.

Lead Scoring: Implement lead scoring to prioritize high-quality leads.

Increasing LTV

Boosting your Customer Lifetime Value (LTV) is another way to improve your LTV:CAC ratio. Here’s how:

Enhancing Customer Retention

Retaining customers longer increases their lifetime value. Here are some retention strategies:

Customer Support: Provide excellent customer service to keep customers happy.

Regular Check-ins: Schedule periodic check-ins to ensure customers are satisfied.

Feedback Loops: Use customer feedback to improve your product and service.

Upselling and Cross-selling Strategies

Encouraging existing customers to purchase more can significantly increase LTV. Try these approaches:

Product Bundles: Offer bundles that provide more value at a discounted rate.

Feature Upgrades: Promote premium features that enhance the customer experience.

Personalized Recommendations: Use data to suggest products or services that match customer needs.

Tools and Software for Tracking LTV and CAC

Overview of Popular Tools

Tracking your LTV (Lifetime Value) and CAC (Customer Acquisition Cost) is crucial for any SaaS business. Thankfully, there are some fantastic tools out there to help you keep tabs on these metrics. Let's dive into three popular options: Geckoboard, Klipfolio, and ChartMogul.

Geckoboard

Geckoboard is a real-time dashboard tool that allows you to visualize your key metrics, including LTV and CAC. It's user-friendly, integrates with various data sources, and provides clear, customizable dashboards. This makes it easier to keep an eye on your metrics without getting lost in a sea of data.

Klipfolio

Klipfolio offers robust data visualization capabilities. It supports a wide range of integrations, allowing you to pull data from multiple sources. Klipfolio's flexibility in creating custom dashboards makes it a powerful tool for tracking LTV and CAC, tailored to your specific needs.

ChartMogul

ChartMogul is specifically designed for subscription businesses. It excels in calculating and analyzing SaaS metrics, including LTV and CAC. With ChartMogul, you can easily track your revenue metrics, segment customers, and get detailed insights into your business performance.

How to Choose the Right Tool

Choosing the right tool for tracking LTV and CAC depends on your specific needs and budget. Here are some key factors to consider:

Key Features to Look For

Integration Capabilities: Ensure the tool integrates with your existing systems and data sources.

Customizability: Look for tools that allow you to create custom dashboards and reports.

Real-Time Data: Real-time tracking can help you make timely decisions.

User-Friendly Interface: A tool that's easy to use will save you time and reduce frustration.

Support and Training: Consider the availability of customer support and training resources.

Cost Considerations

Cost is always a factor when choosing software. Here are some points to keep in mind:

Subscription Fees: Compare the subscription costs of different tools. Some might offer tiered pricing based on features or the number of users.

Hidden Costs: Watch out for additional costs, such as integration fees or charges for extra features.

Free Trials: Take advantage of free trials to test the tools before committing.

For more insights on improving your SaaS metrics, check out our article on the impact of programmatic SEO on SaaS customer lifetime value.

Conclusion

Recap of Key Points

We've covered a lot of ground in this article about LTV SaaS and CAC benchmarks. Here's a quick recap:

Understanding LTV and CAC: We defined Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC), discussed their significance, and explained how to calculate them.

The LTV:CAC Ratio: We explored the importance of the LTV:CAC ratio, what it indicates, and how to calculate it.

Benchmarking Your LTV:CAC Ratio: We looked at industry standards and benchmarks, and how to interpret your company's ratio.

Strategies to Improve Your LTV:CAC Ratio: We provided actionable strategies to reduce CAC and increase LTV, including effective marketing channels and customer retention techniques.

Tools and Software: We reviewed popular tools like Geckoboard, Klipfolio, and ChartMogul for tracking LTV and CAC, and discussed how to choose the right tool for your business.

Final Thoughts and Recommendations

Improving your LTV:CAC ratio is crucial for the success of your SaaS business. Here are some final recommendations:

Focus on Customer Retention: Retaining customers is often more cost-effective than acquiring new ones. Implement strategies to keep your customers happy and engaged.

Optimize Your Sales Funnel: Streamline your sales processes to reduce CAC. Check out our 10 SaaS Sales Funnel Best Practices for more tips.

Leverage Data-Driven Marketing: Use data to identify the most effective marketing channels. For more insights, read our article on Improving Lead Quality and Conversion Rates.

Invest in the Right Tools: Choose tools that provide comprehensive analytics and are easy to integrate with your existing systems. Our guide on Developing a Winning SaaS Growth Strategy can help you make informed decisions.

By focusing on these areas, you can improve your LTV:CAC ratio and drive sustainable growth for your SaaS business. Remember, it's all about finding the right balance between acquiring new customers and maximizing the value of your existing ones.

Additional Resources

Links to Further Reading

To deepen your understanding of SaaS LTV and CAC benchmarks, check out these insightful articles:

The Impact of Programmatic SEO on SaaS Customer Lifetime Value

10 Strategies for Improving Lead Quality and Conversion Rates

How to Develop a High-Performing SaaS Lead Generation Strategy

10 SaaS Sales Funnel Best Practices to Skyrocket Your Revenue

Recommended Tools and Software

Tracking LTV and CAC effectively requires the right tools. Here are some top recommendations:

Geckoboard: A user-friendly dashboard tool that helps you visualize and track key SaaS metrics. Learn more.

Klipfolio: Offers powerful data visualization and reporting capabilities, making it easy to monitor LTV and CAC. Learn more.

ChartMogul: Specifically designed for SaaS businesses, this tool provides detailed analytics on customer metrics. Learn more.

Need help with SEO?

Need help with SEO?

Need help with SEO?

Join our 5-day free course on how to use AI to get more traffic to your website!

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend