The Ultimate Guide to SaaS Valuation- Methods and Best Practices

The Ultimate Guide to SaaS Valuation- Methods and Best Practices

The Ultimate Guide to SaaS Valuation- Methods and Best Practices

Discover the ultimate guide to SaaS valuation, exploring methods and best practices to accurately assess the value of your SaaS business.

Discover the ultimate guide to SaaS valuation, exploring methods and best practices to accurately assess the value of your SaaS business.

Introduction to SaaS Valuation

What is SaaS Valuation?

Ever wonder what your SaaS business is truly worth? Spoiler alert: it's not just about crossing your fingers and hoping for the best. SaaS valuation is the process of determining the economic value of a SaaS company, and it involves some serious number crunching. From revenue multiples to discounted cash flow (DCF) analysis, there's a method to the madness. And trust me, you’ll want to get this right if you're looking to attract investors or sell your business for what it’s really worth.

Importance of Accurate Valuation

Imagine selling your SaaS business for a song, only to discover later that it was worth a symphony. Ouch, right? Accurate valuation is crucial for making informed decisions, whether you're eyeing an exit strategy, wooing investors, or just trying to understand your financial standing. Get it wrong, and you could either leave money on the table or scare off potential investors with a price tag that’s way off the mark. So, let’s get those numbers right, shall we?

Overview of SaaS Market Trends

The SaaS market is hotter than a summer BBQ, with growth trends that would make any entrepreneur's mouth water. From skyrocketing customer acquisition rates to innovative subscription models, the landscape is ever-evolving. Staying abreast of these trends isn’t just for the cool kids; it’s essential for accurate valuation. Understanding market dynamics can help you predict future cash flows and adjust your valuation models accordingly. So, buckle up and get ready to dive into the nitty-gritty of SaaS valuation methods and best practices.

Understanding the value of your SaaS business is key to unlocking its full potential.

For more insights on SaaS financial metrics, check out our comprehensive guide on SaaS financial metrics.

Key Metrics for SaaS Valuation

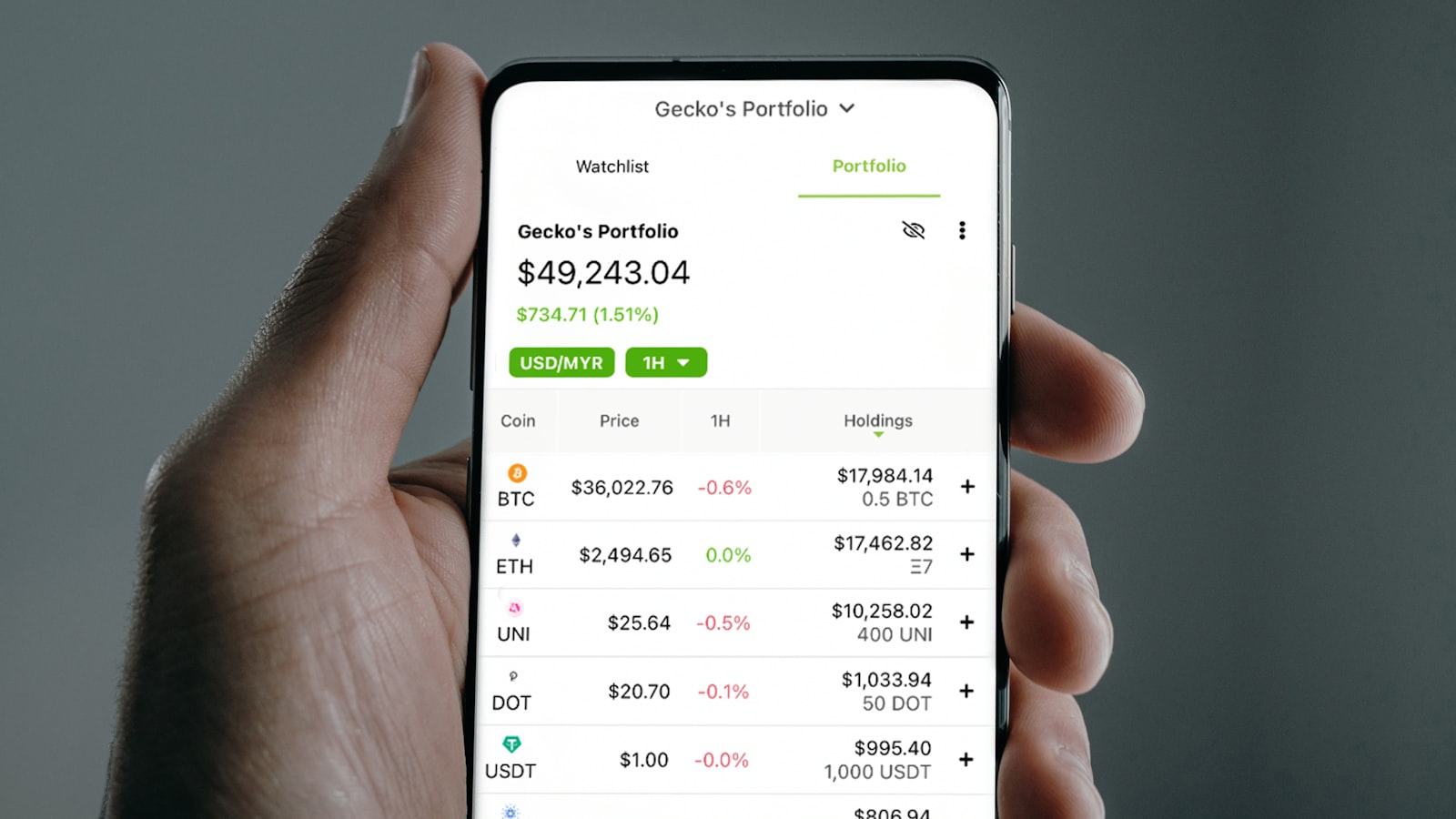

Monthly Recurring Revenue (MRR) vs. Annual Recurring Revenue (ARR)

When it comes to SaaS valuation, understanding the difference between Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) is crucial. MRR provides a snapshot of the predictable monthly income generated from subscriptions, making it a favorite for tracking short-term growth. ARR, on the other hand, offers a broader view, reflecting the total annual income. While MRR is great for spotting trends quickly, ARR is useful for long-term financial planning.

For more insights on optimizing your SaaS revenue streams, check out our guide on creating a SaaS landing page that converts.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) are two sides of the same coin. CAC measures the cost of acquiring a new customer, including marketing and sales expenses. LTV, however, calculates the total revenue a customer is expected to generate during their relationship with your company. A healthy SaaS business typically aims for an LTV to CAC ratio of 3:1, indicating that the revenue from a customer is three times the cost of acquiring them.

To dive deeper into effective customer acquisition strategies, visit our article on developing a winning B2B SaaS marketing strategy.

Churn Rate and Retention Metrics

Churn rate is the percentage of customers who cancel their subscriptions over a given period. High churn rates can be a red flag, indicating customer dissatisfaction or market fit issues. Retention metrics, on the other hand, measure how well you keep your customers engaged and subscribed. Lower churn and higher retention rates are positive indicators for SaaS valuation.

For strategies on reducing churn and improving customer retention, check out our post on creating a scalable SaaS training program.

Gross Margins and Profitability

Gross margins reflect the percentage of revenue remaining after deducting the cost of goods sold (COGS). High gross margins indicate efficient operations and the potential for higher profitability. For SaaS companies, maintaining gross margins above 70% is often considered healthy. Profitability, while not always the primary focus for growing SaaS businesses, remains a key metric for valuation, especially when considering long-term sustainability.

Learn more about optimizing your SaaS business for profitability in our guide on developing and executing a winning SaaS growth strategy.

Net Revenue Retention (NRR) and Rule of 40

Net Revenue Retention (NRR) measures the revenue growth or decline from existing customers, accounting for upgrades, downgrades, and churn. An NRR above 100% indicates that your existing customers are generating more revenue over time, a positive sign for valuation. The Rule of 40 is a SaaS industry benchmark combining growth rate and profit margin. If the sum of your growth rate and profit margin exceeds 40%, your business is generally considered to be in good health.

For more on achieving high NRR and meeting the Rule of 40, explore our article on how programmatic SEO drives leads for B2B SaaS.

Valuation Methods

Revenue Multiples

Revenue multiples are a popular method for valuing SaaS companies. This approach involves applying a multiple to the company's revenue, usually based on industry standards or comparable company valuations. For instance, if a SaaS company generates $10 million in annual revenue and the industry multiple is 5x, the company would be valued at $50 million.

Key factors influencing the multiple include:

Growth rate

Market position

Customer base

Revenue multiples are straightforward and provide a quick snapshot of a company's value. However, they don't account for profitability or cash flow, which can be critical for a comprehensive valuation.

EBITDA Multiples

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples offer a more nuanced view by focusing on a company's operating performance. This method applies a multiple to the company's EBITDA, reflecting its ability to generate earnings from operations.

For example, if a SaaS company has an EBITDA of $5 million and the industry multiple is 8x, the valuation would be $40 million.

EBITDA multiples are particularly useful for comparing companies with different capital structures and tax situations, providing a clearer picture of operational efficiency.

Seller Discretionary Earnings (SDE)

Seller Discretionary Earnings (SDE) is often used for smaller SaaS companies. SDE includes the company's earnings before taxes, interest, depreciation, and amortization, plus the owner's compensation and benefits. This method highlights the total financial benefit a single owner-operator could derive from the business.

To calculate SDE, you add back any expenses that are discretionary or non-recurring, such as personal expenses run through the business or one-time costs.

SDE is particularly relevant for businesses where the owner's involvement is significant, providing a clearer picture of the company's true earning potential.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a more complex method that estimates a company's value based on its future cash flow projections, discounted back to their present value. This method requires detailed financial forecasting and an appropriate discount rate, often reflecting the company's cost of capital.

Steps to perform a DCF analysis:

Project future cash flows

Determine the discount rate

Calculate the present value of future cash flows

DCF analysis is comprehensive and considers the time value of money, making it a robust method for valuing SaaS companies with predictable cash flows.

For more insights on SaaS strategies that can impact valuation, check out our articles on B2B SaaS marketing strategies and SaaS growth strategies.

Factors Influencing SaaS Valuation Multiples

Growth Rate and Scalability

Growth rate is like the rocket fuel for your SaaS valuation. Investors love a company that's not just growing, but scaling efficiently. A high growth rate indicates a strong market demand and effective business model. Scalability is equally important—your ability to handle increased workload without a proportional increase in costs can make or break your valuation.

For more tips on creating a scalable SaaS training program, check out this guide.

Market Position and Competition

Your market position and the level of competition you face play a critical role in determining your valuation multiple. A strong market position with a unique value proposition can significantly boost your valuation. Conversely, a crowded market with fierce competition might lower it. Understanding your competitors and differentiating your product is key.

Learn how to develop a winning B2B SaaS marketing strategy here.

Customer Base and Concentration

A diversified customer base is like a safety net for your valuation. If your revenue heavily relies on a few customers, it poses a risk. Investors prefer a broad customer base to mitigate this risk. Additionally, understanding your customer acquisition channels and focusing on retention can make your business more attractive.

Discover how to develop and execute a winning SaaS growth strategy here.

Intellectual Property and Technology Stack

Intellectual property (IP) and your technology stack are like the crown jewels of your SaaS business. Proprietary technology and strong IP protection can significantly enhance your valuation. Investors look for robust, scalable, and secure technology stacks that can support future growth and innovation.

For insights on programmatic SEO strategies for B2B SaaS companies, visit this page.

Funding Status and Financial Health

Your funding status and overall financial health are critical factors in determining your valuation multiple. A well-funded company with a healthy balance sheet is more attractive to investors. It shows that you have the resources to sustain growth and weather financial challenges. Regular financial audits and transparent reporting can further enhance your valuation.

Learn how programmatic SEO drives leads for B2B SaaS here.

Best Practices to Increase SaaS Valuation

Reducing Churn and Improving Retention

Reducing churn is like plugging a leaky bucket. If your customers are leaving faster than you can onboard new ones, your SaaS valuation will suffer. Focus on:

Enhancing customer support

Offering personalized onboarding experiences

Regularly updating your product based on user feedback

For more detailed strategies on customer retention, check out our guide on creating a scalable SaaS training program.

Optimizing Pricing Strategies

Your pricing strategy can make or break your SaaS business. To optimize pricing:

Conduct market research to understand what your competitors are charging

Test different pricing tiers to find what resonates with your customers

Consider value-based pricing to align your prices with the perceived value of your product

For more insights, read our article on developing a winning B2B SaaS marketing strategy.

Enhancing Customer Acquisition Channels

Diversifying and strengthening your customer acquisition channels is crucial. Effective methods include:

Investing in content marketing and SEO

Leveraging social media and paid advertising

Building strategic partnerships and referral programs

Learn more about effective acquisition strategies in our post on developing and executing a winning SaaS growth strategy.

Securing Intellectual Property

Protecting your intellectual property (IP) is essential for maintaining your competitive edge. Steps to secure IP include:

Filing for patents and trademarks

Implementing strong cybersecurity measures

Regularly updating your software to prevent vulnerabilities

For more on safeguarding your business, explore our article on proven B2B SaaS SEO tactics.

Documenting Processes and Outsourcing

Well-documented processes make your business more attractive to buyers. Consider:

Creating detailed SOPs (Standard Operating Procedures)

Outsourcing non-core activities to increase efficiency

Using project management tools to keep everything organized

For tips on building an efficient team, check out our guide on building a high-performing in-house marketing team.

Preparing for a Sale or Investment

Timing the Market

Timing is everything when it comes to selling or seeking investment in your SaaS business. The market's current state can significantly impact your valuation. For instance, selling during a market upswing can fetch a higher price. Conversely, a downturn might lead to a lower valuation. Keep a close eye on industry trends and economic indicators to make the most informed decision.

Due Diligence and Financial Documentation

Before you even think about selling, ensure your financial documentation is in tip-top shape. This includes:

Accurate financial statements

Detailed records of revenue and expenses

Comprehensive customer data

Clear documentation of intellectual property

Potential buyers or investors will scrutinize these documents, so it's crucial to have everything organized and transparent.

Working with Brokers and Advisors

Engaging with brokers and advisors can be a game-changer. These professionals bring expertise and a network of potential buyers or investors. They can help you:

Identify the right buyers or investors

Negotiate better terms

Navigate the complexities of the sale process

For more on building a high-performing team, check out our guide on building a high-performing in-house marketing team.

Negotiating Terms and Conditions

When it comes to negotiation, it's not just about the price. Terms and conditions can make or break the deal. Key points to consider include:

Payment structure (lump sum vs. installments)

Retention clauses for key employees

Non-compete agreements

Be prepared to compromise, but also know your non-negotiables.

Post-Sale Integration and Transition

The sale doesn't end at signing the dotted line. Post-sale integration is critical for a smooth transition. Plan for:

Employee retention strategies

Customer communication plans

Operational handover processes

Ensuring a seamless transition will help maintain business continuity and preserve the value of your SaaS company.

For more insights on SaaS strategies, explore our article on developing and executing a winning SaaS growth strategy.

Conclusion

Recap of Key Points

Throughout this guide, we've covered the essential aspects of SaaS valuation. Here's a quick recap:

Key Metrics: Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Lifetime Value (LTV), Churn Rate, Retention Metrics, Gross Margins, Profitability, and Net Revenue Retention (NRR).

Valuation Methods: Revenue Multiples, EBITDA Multiples, Seller Discretionary Earnings (SDE), and Discounted Cash Flow (DCF) Analysis.

Influencing Factors: Growth Rate, Market Position, Customer Base, Intellectual Property, and Financial Health.

Best Practices: Reducing Churn, Optimizing Pricing, Enhancing Customer Acquisition, Securing Intellectual Property, and Documenting Processes.

Preparation for Sale: Timing the Market, Due Diligence, Working with Brokers, Negotiating Terms, and Post-Sale Integration.

Future Trends in SaaS Valuation

As the SaaS industry continues to mature, several trends are likely to shape future valuations:

Increased Emphasis on Retention: With customer acquisition costs rising, retaining existing customers will become even more critical.

Advanced Pricing Models: Companies will experiment with innovative pricing strategies to maximize revenue.

Greater Focus on Data Security: As data breaches become more common, robust security measures will be a significant valuation driver.

Integration of AI and Automation: Leveraging AI and automation will enhance operational efficiency and value.

Environmental, Social, and Governance (ESG) Factors: Investors will increasingly consider ESG criteria in their valuation assessments.

Final Thoughts and Recommendations

Accurate SaaS valuation is both an art and a science. By focusing on the right metrics, employing suitable valuation methods, and staying ahead of industry trends, you can maximize your company's worth. Here are some final tips:

Stay Informed: Keep up with industry trends and adjust your strategies accordingly. For insights on developing a winning SaaS marketing strategy, visit this guide.

Optimize Continuously: Regularly review and optimize your pricing strategies, customer acquisition channels, and retention efforts. Check out this article for growth strategies.

Document Everything: Ensure all processes are well-documented and consider outsourcing where necessary to maintain efficiency. Learn more about building a high-performing team here.

By following these recommendations, you'll be well-equipped to navigate the complexities of SaaS valuation and drive your business towards greater success.

Introduction to SaaS Valuation

What is SaaS Valuation?

Ever wonder what your SaaS business is truly worth? Spoiler alert: it's not just about crossing your fingers and hoping for the best. SaaS valuation is the process of determining the economic value of a SaaS company, and it involves some serious number crunching. From revenue multiples to discounted cash flow (DCF) analysis, there's a method to the madness. And trust me, you’ll want to get this right if you're looking to attract investors or sell your business for what it’s really worth.

Importance of Accurate Valuation

Imagine selling your SaaS business for a song, only to discover later that it was worth a symphony. Ouch, right? Accurate valuation is crucial for making informed decisions, whether you're eyeing an exit strategy, wooing investors, or just trying to understand your financial standing. Get it wrong, and you could either leave money on the table or scare off potential investors with a price tag that’s way off the mark. So, let’s get those numbers right, shall we?

Overview of SaaS Market Trends

The SaaS market is hotter than a summer BBQ, with growth trends that would make any entrepreneur's mouth water. From skyrocketing customer acquisition rates to innovative subscription models, the landscape is ever-evolving. Staying abreast of these trends isn’t just for the cool kids; it’s essential for accurate valuation. Understanding market dynamics can help you predict future cash flows and adjust your valuation models accordingly. So, buckle up and get ready to dive into the nitty-gritty of SaaS valuation methods and best practices.

Understanding the value of your SaaS business is key to unlocking its full potential.

For more insights on SaaS financial metrics, check out our comprehensive guide on SaaS financial metrics.

Key Metrics for SaaS Valuation

Monthly Recurring Revenue (MRR) vs. Annual Recurring Revenue (ARR)

When it comes to SaaS valuation, understanding the difference between Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) is crucial. MRR provides a snapshot of the predictable monthly income generated from subscriptions, making it a favorite for tracking short-term growth. ARR, on the other hand, offers a broader view, reflecting the total annual income. While MRR is great for spotting trends quickly, ARR is useful for long-term financial planning.

For more insights on optimizing your SaaS revenue streams, check out our guide on creating a SaaS landing page that converts.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) are two sides of the same coin. CAC measures the cost of acquiring a new customer, including marketing and sales expenses. LTV, however, calculates the total revenue a customer is expected to generate during their relationship with your company. A healthy SaaS business typically aims for an LTV to CAC ratio of 3:1, indicating that the revenue from a customer is three times the cost of acquiring them.

To dive deeper into effective customer acquisition strategies, visit our article on developing a winning B2B SaaS marketing strategy.

Churn Rate and Retention Metrics

Churn rate is the percentage of customers who cancel their subscriptions over a given period. High churn rates can be a red flag, indicating customer dissatisfaction or market fit issues. Retention metrics, on the other hand, measure how well you keep your customers engaged and subscribed. Lower churn and higher retention rates are positive indicators for SaaS valuation.

For strategies on reducing churn and improving customer retention, check out our post on creating a scalable SaaS training program.

Gross Margins and Profitability

Gross margins reflect the percentage of revenue remaining after deducting the cost of goods sold (COGS). High gross margins indicate efficient operations and the potential for higher profitability. For SaaS companies, maintaining gross margins above 70% is often considered healthy. Profitability, while not always the primary focus for growing SaaS businesses, remains a key metric for valuation, especially when considering long-term sustainability.

Learn more about optimizing your SaaS business for profitability in our guide on developing and executing a winning SaaS growth strategy.

Net Revenue Retention (NRR) and Rule of 40

Net Revenue Retention (NRR) measures the revenue growth or decline from existing customers, accounting for upgrades, downgrades, and churn. An NRR above 100% indicates that your existing customers are generating more revenue over time, a positive sign for valuation. The Rule of 40 is a SaaS industry benchmark combining growth rate and profit margin. If the sum of your growth rate and profit margin exceeds 40%, your business is generally considered to be in good health.

For more on achieving high NRR and meeting the Rule of 40, explore our article on how programmatic SEO drives leads for B2B SaaS.

Valuation Methods

Revenue Multiples

Revenue multiples are a popular method for valuing SaaS companies. This approach involves applying a multiple to the company's revenue, usually based on industry standards or comparable company valuations. For instance, if a SaaS company generates $10 million in annual revenue and the industry multiple is 5x, the company would be valued at $50 million.

Key factors influencing the multiple include:

Growth rate

Market position

Customer base

Revenue multiples are straightforward and provide a quick snapshot of a company's value. However, they don't account for profitability or cash flow, which can be critical for a comprehensive valuation.

EBITDA Multiples

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples offer a more nuanced view by focusing on a company's operating performance. This method applies a multiple to the company's EBITDA, reflecting its ability to generate earnings from operations.

For example, if a SaaS company has an EBITDA of $5 million and the industry multiple is 8x, the valuation would be $40 million.

EBITDA multiples are particularly useful for comparing companies with different capital structures and tax situations, providing a clearer picture of operational efficiency.

Seller Discretionary Earnings (SDE)

Seller Discretionary Earnings (SDE) is often used for smaller SaaS companies. SDE includes the company's earnings before taxes, interest, depreciation, and amortization, plus the owner's compensation and benefits. This method highlights the total financial benefit a single owner-operator could derive from the business.

To calculate SDE, you add back any expenses that are discretionary or non-recurring, such as personal expenses run through the business or one-time costs.

SDE is particularly relevant for businesses where the owner's involvement is significant, providing a clearer picture of the company's true earning potential.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a more complex method that estimates a company's value based on its future cash flow projections, discounted back to their present value. This method requires detailed financial forecasting and an appropriate discount rate, often reflecting the company's cost of capital.

Steps to perform a DCF analysis:

Project future cash flows

Determine the discount rate

Calculate the present value of future cash flows

DCF analysis is comprehensive and considers the time value of money, making it a robust method for valuing SaaS companies with predictable cash flows.

For more insights on SaaS strategies that can impact valuation, check out our articles on B2B SaaS marketing strategies and SaaS growth strategies.

Factors Influencing SaaS Valuation Multiples

Growth Rate and Scalability

Growth rate is like the rocket fuel for your SaaS valuation. Investors love a company that's not just growing, but scaling efficiently. A high growth rate indicates a strong market demand and effective business model. Scalability is equally important—your ability to handle increased workload without a proportional increase in costs can make or break your valuation.

For more tips on creating a scalable SaaS training program, check out this guide.

Market Position and Competition

Your market position and the level of competition you face play a critical role in determining your valuation multiple. A strong market position with a unique value proposition can significantly boost your valuation. Conversely, a crowded market with fierce competition might lower it. Understanding your competitors and differentiating your product is key.

Learn how to develop a winning B2B SaaS marketing strategy here.

Customer Base and Concentration

A diversified customer base is like a safety net for your valuation. If your revenue heavily relies on a few customers, it poses a risk. Investors prefer a broad customer base to mitigate this risk. Additionally, understanding your customer acquisition channels and focusing on retention can make your business more attractive.

Discover how to develop and execute a winning SaaS growth strategy here.

Intellectual Property and Technology Stack

Intellectual property (IP) and your technology stack are like the crown jewels of your SaaS business. Proprietary technology and strong IP protection can significantly enhance your valuation. Investors look for robust, scalable, and secure technology stacks that can support future growth and innovation.

For insights on programmatic SEO strategies for B2B SaaS companies, visit this page.

Funding Status and Financial Health

Your funding status and overall financial health are critical factors in determining your valuation multiple. A well-funded company with a healthy balance sheet is more attractive to investors. It shows that you have the resources to sustain growth and weather financial challenges. Regular financial audits and transparent reporting can further enhance your valuation.

Learn how programmatic SEO drives leads for B2B SaaS here.

Best Practices to Increase SaaS Valuation

Reducing Churn and Improving Retention

Reducing churn is like plugging a leaky bucket. If your customers are leaving faster than you can onboard new ones, your SaaS valuation will suffer. Focus on:

Enhancing customer support

Offering personalized onboarding experiences

Regularly updating your product based on user feedback

For more detailed strategies on customer retention, check out our guide on creating a scalable SaaS training program.

Optimizing Pricing Strategies

Your pricing strategy can make or break your SaaS business. To optimize pricing:

Conduct market research to understand what your competitors are charging

Test different pricing tiers to find what resonates with your customers

Consider value-based pricing to align your prices with the perceived value of your product

For more insights, read our article on developing a winning B2B SaaS marketing strategy.

Enhancing Customer Acquisition Channels

Diversifying and strengthening your customer acquisition channels is crucial. Effective methods include:

Investing in content marketing and SEO

Leveraging social media and paid advertising

Building strategic partnerships and referral programs

Learn more about effective acquisition strategies in our post on developing and executing a winning SaaS growth strategy.

Securing Intellectual Property

Protecting your intellectual property (IP) is essential for maintaining your competitive edge. Steps to secure IP include:

Filing for patents and trademarks

Implementing strong cybersecurity measures

Regularly updating your software to prevent vulnerabilities

For more on safeguarding your business, explore our article on proven B2B SaaS SEO tactics.

Documenting Processes and Outsourcing

Well-documented processes make your business more attractive to buyers. Consider:

Creating detailed SOPs (Standard Operating Procedures)

Outsourcing non-core activities to increase efficiency

Using project management tools to keep everything organized

For tips on building an efficient team, check out our guide on building a high-performing in-house marketing team.

Preparing for a Sale or Investment

Timing the Market

Timing is everything when it comes to selling or seeking investment in your SaaS business. The market's current state can significantly impact your valuation. For instance, selling during a market upswing can fetch a higher price. Conversely, a downturn might lead to a lower valuation. Keep a close eye on industry trends and economic indicators to make the most informed decision.

Due Diligence and Financial Documentation

Before you even think about selling, ensure your financial documentation is in tip-top shape. This includes:

Accurate financial statements

Detailed records of revenue and expenses

Comprehensive customer data

Clear documentation of intellectual property

Potential buyers or investors will scrutinize these documents, so it's crucial to have everything organized and transparent.

Working with Brokers and Advisors

Engaging with brokers and advisors can be a game-changer. These professionals bring expertise and a network of potential buyers or investors. They can help you:

Identify the right buyers or investors

Negotiate better terms

Navigate the complexities of the sale process

For more on building a high-performing team, check out our guide on building a high-performing in-house marketing team.

Negotiating Terms and Conditions

When it comes to negotiation, it's not just about the price. Terms and conditions can make or break the deal. Key points to consider include:

Payment structure (lump sum vs. installments)

Retention clauses for key employees

Non-compete agreements

Be prepared to compromise, but also know your non-negotiables.

Post-Sale Integration and Transition

The sale doesn't end at signing the dotted line. Post-sale integration is critical for a smooth transition. Plan for:

Employee retention strategies

Customer communication plans

Operational handover processes

Ensuring a seamless transition will help maintain business continuity and preserve the value of your SaaS company.

For more insights on SaaS strategies, explore our article on developing and executing a winning SaaS growth strategy.

Conclusion

Recap of Key Points

Throughout this guide, we've covered the essential aspects of SaaS valuation. Here's a quick recap:

Key Metrics: Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Lifetime Value (LTV), Churn Rate, Retention Metrics, Gross Margins, Profitability, and Net Revenue Retention (NRR).

Valuation Methods: Revenue Multiples, EBITDA Multiples, Seller Discretionary Earnings (SDE), and Discounted Cash Flow (DCF) Analysis.

Influencing Factors: Growth Rate, Market Position, Customer Base, Intellectual Property, and Financial Health.

Best Practices: Reducing Churn, Optimizing Pricing, Enhancing Customer Acquisition, Securing Intellectual Property, and Documenting Processes.

Preparation for Sale: Timing the Market, Due Diligence, Working with Brokers, Negotiating Terms, and Post-Sale Integration.

Future Trends in SaaS Valuation

As the SaaS industry continues to mature, several trends are likely to shape future valuations:

Increased Emphasis on Retention: With customer acquisition costs rising, retaining existing customers will become even more critical.

Advanced Pricing Models: Companies will experiment with innovative pricing strategies to maximize revenue.

Greater Focus on Data Security: As data breaches become more common, robust security measures will be a significant valuation driver.

Integration of AI and Automation: Leveraging AI and automation will enhance operational efficiency and value.

Environmental, Social, and Governance (ESG) Factors: Investors will increasingly consider ESG criteria in their valuation assessments.

Final Thoughts and Recommendations

Accurate SaaS valuation is both an art and a science. By focusing on the right metrics, employing suitable valuation methods, and staying ahead of industry trends, you can maximize your company's worth. Here are some final tips:

Stay Informed: Keep up with industry trends and adjust your strategies accordingly. For insights on developing a winning SaaS marketing strategy, visit this guide.

Optimize Continuously: Regularly review and optimize your pricing strategies, customer acquisition channels, and retention efforts. Check out this article for growth strategies.

Document Everything: Ensure all processes are well-documented and consider outsourcing where necessary to maintain efficiency. Learn more about building a high-performing team here.

By following these recommendations, you'll be well-equipped to navigate the complexities of SaaS valuation and drive your business towards greater success.

Introduction to SaaS Valuation

What is SaaS Valuation?

Ever wonder what your SaaS business is truly worth? Spoiler alert: it's not just about crossing your fingers and hoping for the best. SaaS valuation is the process of determining the economic value of a SaaS company, and it involves some serious number crunching. From revenue multiples to discounted cash flow (DCF) analysis, there's a method to the madness. And trust me, you’ll want to get this right if you're looking to attract investors or sell your business for what it’s really worth.

Importance of Accurate Valuation

Imagine selling your SaaS business for a song, only to discover later that it was worth a symphony. Ouch, right? Accurate valuation is crucial for making informed decisions, whether you're eyeing an exit strategy, wooing investors, or just trying to understand your financial standing. Get it wrong, and you could either leave money on the table or scare off potential investors with a price tag that’s way off the mark. So, let’s get those numbers right, shall we?

Overview of SaaS Market Trends

The SaaS market is hotter than a summer BBQ, with growth trends that would make any entrepreneur's mouth water. From skyrocketing customer acquisition rates to innovative subscription models, the landscape is ever-evolving. Staying abreast of these trends isn’t just for the cool kids; it’s essential for accurate valuation. Understanding market dynamics can help you predict future cash flows and adjust your valuation models accordingly. So, buckle up and get ready to dive into the nitty-gritty of SaaS valuation methods and best practices.

Understanding the value of your SaaS business is key to unlocking its full potential.

For more insights on SaaS financial metrics, check out our comprehensive guide on SaaS financial metrics.

Key Metrics for SaaS Valuation

Monthly Recurring Revenue (MRR) vs. Annual Recurring Revenue (ARR)

When it comes to SaaS valuation, understanding the difference between Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) is crucial. MRR provides a snapshot of the predictable monthly income generated from subscriptions, making it a favorite for tracking short-term growth. ARR, on the other hand, offers a broader view, reflecting the total annual income. While MRR is great for spotting trends quickly, ARR is useful for long-term financial planning.

For more insights on optimizing your SaaS revenue streams, check out our guide on creating a SaaS landing page that converts.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) are two sides of the same coin. CAC measures the cost of acquiring a new customer, including marketing and sales expenses. LTV, however, calculates the total revenue a customer is expected to generate during their relationship with your company. A healthy SaaS business typically aims for an LTV to CAC ratio of 3:1, indicating that the revenue from a customer is three times the cost of acquiring them.

To dive deeper into effective customer acquisition strategies, visit our article on developing a winning B2B SaaS marketing strategy.

Churn Rate and Retention Metrics

Churn rate is the percentage of customers who cancel their subscriptions over a given period. High churn rates can be a red flag, indicating customer dissatisfaction or market fit issues. Retention metrics, on the other hand, measure how well you keep your customers engaged and subscribed. Lower churn and higher retention rates are positive indicators for SaaS valuation.

For strategies on reducing churn and improving customer retention, check out our post on creating a scalable SaaS training program.

Gross Margins and Profitability

Gross margins reflect the percentage of revenue remaining after deducting the cost of goods sold (COGS). High gross margins indicate efficient operations and the potential for higher profitability. For SaaS companies, maintaining gross margins above 70% is often considered healthy. Profitability, while not always the primary focus for growing SaaS businesses, remains a key metric for valuation, especially when considering long-term sustainability.

Learn more about optimizing your SaaS business for profitability in our guide on developing and executing a winning SaaS growth strategy.

Net Revenue Retention (NRR) and Rule of 40

Net Revenue Retention (NRR) measures the revenue growth or decline from existing customers, accounting for upgrades, downgrades, and churn. An NRR above 100% indicates that your existing customers are generating more revenue over time, a positive sign for valuation. The Rule of 40 is a SaaS industry benchmark combining growth rate and profit margin. If the sum of your growth rate and profit margin exceeds 40%, your business is generally considered to be in good health.

For more on achieving high NRR and meeting the Rule of 40, explore our article on how programmatic SEO drives leads for B2B SaaS.

Valuation Methods

Revenue Multiples

Revenue multiples are a popular method for valuing SaaS companies. This approach involves applying a multiple to the company's revenue, usually based on industry standards or comparable company valuations. For instance, if a SaaS company generates $10 million in annual revenue and the industry multiple is 5x, the company would be valued at $50 million.

Key factors influencing the multiple include:

Growth rate

Market position

Customer base

Revenue multiples are straightforward and provide a quick snapshot of a company's value. However, they don't account for profitability or cash flow, which can be critical for a comprehensive valuation.

EBITDA Multiples

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples offer a more nuanced view by focusing on a company's operating performance. This method applies a multiple to the company's EBITDA, reflecting its ability to generate earnings from operations.

For example, if a SaaS company has an EBITDA of $5 million and the industry multiple is 8x, the valuation would be $40 million.

EBITDA multiples are particularly useful for comparing companies with different capital structures and tax situations, providing a clearer picture of operational efficiency.

Seller Discretionary Earnings (SDE)

Seller Discretionary Earnings (SDE) is often used for smaller SaaS companies. SDE includes the company's earnings before taxes, interest, depreciation, and amortization, plus the owner's compensation and benefits. This method highlights the total financial benefit a single owner-operator could derive from the business.

To calculate SDE, you add back any expenses that are discretionary or non-recurring, such as personal expenses run through the business or one-time costs.

SDE is particularly relevant for businesses where the owner's involvement is significant, providing a clearer picture of the company's true earning potential.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a more complex method that estimates a company's value based on its future cash flow projections, discounted back to their present value. This method requires detailed financial forecasting and an appropriate discount rate, often reflecting the company's cost of capital.

Steps to perform a DCF analysis:

Project future cash flows

Determine the discount rate

Calculate the present value of future cash flows

DCF analysis is comprehensive and considers the time value of money, making it a robust method for valuing SaaS companies with predictable cash flows.

For more insights on SaaS strategies that can impact valuation, check out our articles on B2B SaaS marketing strategies and SaaS growth strategies.

Factors Influencing SaaS Valuation Multiples

Growth Rate and Scalability

Growth rate is like the rocket fuel for your SaaS valuation. Investors love a company that's not just growing, but scaling efficiently. A high growth rate indicates a strong market demand and effective business model. Scalability is equally important—your ability to handle increased workload without a proportional increase in costs can make or break your valuation.

For more tips on creating a scalable SaaS training program, check out this guide.

Market Position and Competition

Your market position and the level of competition you face play a critical role in determining your valuation multiple. A strong market position with a unique value proposition can significantly boost your valuation. Conversely, a crowded market with fierce competition might lower it. Understanding your competitors and differentiating your product is key.

Learn how to develop a winning B2B SaaS marketing strategy here.

Customer Base and Concentration

A diversified customer base is like a safety net for your valuation. If your revenue heavily relies on a few customers, it poses a risk. Investors prefer a broad customer base to mitigate this risk. Additionally, understanding your customer acquisition channels and focusing on retention can make your business more attractive.

Discover how to develop and execute a winning SaaS growth strategy here.

Intellectual Property and Technology Stack

Intellectual property (IP) and your technology stack are like the crown jewels of your SaaS business. Proprietary technology and strong IP protection can significantly enhance your valuation. Investors look for robust, scalable, and secure technology stacks that can support future growth and innovation.

For insights on programmatic SEO strategies for B2B SaaS companies, visit this page.

Funding Status and Financial Health

Your funding status and overall financial health are critical factors in determining your valuation multiple. A well-funded company with a healthy balance sheet is more attractive to investors. It shows that you have the resources to sustain growth and weather financial challenges. Regular financial audits and transparent reporting can further enhance your valuation.

Learn how programmatic SEO drives leads for B2B SaaS here.

Best Practices to Increase SaaS Valuation

Reducing Churn and Improving Retention

Reducing churn is like plugging a leaky bucket. If your customers are leaving faster than you can onboard new ones, your SaaS valuation will suffer. Focus on:

Enhancing customer support

Offering personalized onboarding experiences

Regularly updating your product based on user feedback

For more detailed strategies on customer retention, check out our guide on creating a scalable SaaS training program.

Optimizing Pricing Strategies

Your pricing strategy can make or break your SaaS business. To optimize pricing:

Conduct market research to understand what your competitors are charging

Test different pricing tiers to find what resonates with your customers

Consider value-based pricing to align your prices with the perceived value of your product

For more insights, read our article on developing a winning B2B SaaS marketing strategy.

Enhancing Customer Acquisition Channels

Diversifying and strengthening your customer acquisition channels is crucial. Effective methods include:

Investing in content marketing and SEO

Leveraging social media and paid advertising

Building strategic partnerships and referral programs

Learn more about effective acquisition strategies in our post on developing and executing a winning SaaS growth strategy.

Securing Intellectual Property

Protecting your intellectual property (IP) is essential for maintaining your competitive edge. Steps to secure IP include:

Filing for patents and trademarks

Implementing strong cybersecurity measures

Regularly updating your software to prevent vulnerabilities

For more on safeguarding your business, explore our article on proven B2B SaaS SEO tactics.

Documenting Processes and Outsourcing

Well-documented processes make your business more attractive to buyers. Consider:

Creating detailed SOPs (Standard Operating Procedures)

Outsourcing non-core activities to increase efficiency

Using project management tools to keep everything organized

For tips on building an efficient team, check out our guide on building a high-performing in-house marketing team.

Preparing for a Sale or Investment

Timing the Market

Timing is everything when it comes to selling or seeking investment in your SaaS business. The market's current state can significantly impact your valuation. For instance, selling during a market upswing can fetch a higher price. Conversely, a downturn might lead to a lower valuation. Keep a close eye on industry trends and economic indicators to make the most informed decision.

Due Diligence and Financial Documentation

Before you even think about selling, ensure your financial documentation is in tip-top shape. This includes:

Accurate financial statements

Detailed records of revenue and expenses

Comprehensive customer data

Clear documentation of intellectual property

Potential buyers or investors will scrutinize these documents, so it's crucial to have everything organized and transparent.

Working with Brokers and Advisors

Engaging with brokers and advisors can be a game-changer. These professionals bring expertise and a network of potential buyers or investors. They can help you:

Identify the right buyers or investors

Negotiate better terms

Navigate the complexities of the sale process

For more on building a high-performing team, check out our guide on building a high-performing in-house marketing team.

Negotiating Terms and Conditions

When it comes to negotiation, it's not just about the price. Terms and conditions can make or break the deal. Key points to consider include:

Payment structure (lump sum vs. installments)

Retention clauses for key employees

Non-compete agreements

Be prepared to compromise, but also know your non-negotiables.

Post-Sale Integration and Transition

The sale doesn't end at signing the dotted line. Post-sale integration is critical for a smooth transition. Plan for:

Employee retention strategies

Customer communication plans

Operational handover processes

Ensuring a seamless transition will help maintain business continuity and preserve the value of your SaaS company.

For more insights on SaaS strategies, explore our article on developing and executing a winning SaaS growth strategy.

Conclusion

Recap of Key Points

Throughout this guide, we've covered the essential aspects of SaaS valuation. Here's a quick recap:

Key Metrics: Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Lifetime Value (LTV), Churn Rate, Retention Metrics, Gross Margins, Profitability, and Net Revenue Retention (NRR).

Valuation Methods: Revenue Multiples, EBITDA Multiples, Seller Discretionary Earnings (SDE), and Discounted Cash Flow (DCF) Analysis.

Influencing Factors: Growth Rate, Market Position, Customer Base, Intellectual Property, and Financial Health.

Best Practices: Reducing Churn, Optimizing Pricing, Enhancing Customer Acquisition, Securing Intellectual Property, and Documenting Processes.

Preparation for Sale: Timing the Market, Due Diligence, Working with Brokers, Negotiating Terms, and Post-Sale Integration.

Future Trends in SaaS Valuation

As the SaaS industry continues to mature, several trends are likely to shape future valuations:

Increased Emphasis on Retention: With customer acquisition costs rising, retaining existing customers will become even more critical.

Advanced Pricing Models: Companies will experiment with innovative pricing strategies to maximize revenue.

Greater Focus on Data Security: As data breaches become more common, robust security measures will be a significant valuation driver.

Integration of AI and Automation: Leveraging AI and automation will enhance operational efficiency and value.

Environmental, Social, and Governance (ESG) Factors: Investors will increasingly consider ESG criteria in their valuation assessments.

Final Thoughts and Recommendations

Accurate SaaS valuation is both an art and a science. By focusing on the right metrics, employing suitable valuation methods, and staying ahead of industry trends, you can maximize your company's worth. Here are some final tips:

Stay Informed: Keep up with industry trends and adjust your strategies accordingly. For insights on developing a winning SaaS marketing strategy, visit this guide.

Optimize Continuously: Regularly review and optimize your pricing strategies, customer acquisition channels, and retention efforts. Check out this article for growth strategies.

Document Everything: Ensure all processes are well-documented and consider outsourcing where necessary to maintain efficiency. Learn more about building a high-performing team here.

By following these recommendations, you'll be well-equipped to navigate the complexities of SaaS valuation and drive your business towards greater success.

Need help with SEO?

Need help with SEO?

Need help with SEO?

Join our 5-day free course on how to use AI to get more traffic to your website!

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend

Explode your organic traffic and generate red-hot leads without spending a fortune on ads

Claim the top spot on search rankings for the most lucrative keywords in your industry

Cement your position as the undisputed authority in your niche, fostering unshakable trust and loyalty

Skyrocket your conversion rates and revenue with irresistible, customer-centric content

Conquer untapped markets and expand your reach by seizing hidden keyword opportunities

Liberate your time and resources from tedious content tasks, so you can focus on scaling your business

Gain laser-sharp insights into your ideal customers' minds, enabling you to create products and content they can't resist

Harness the power of data-driven decision-making to optimize your marketing for maximum impact

Achieve unstoppable, long-term organic growth without being held hostage by algorithm updates or ad costs

Stay light-years ahead of the competition by leveraging cutting-edge AI to adapt to any market shift or customer trend